Make a positive impact and earn with Solar Lords Closing School

Solar Lords Closing School works with official, state-supported clean energy programs

that lower emissions and offer guaranteed savings. Promote clean energy in your

community and earn with us!

Make a positive impact and earn

with Solar Lords Closing School

Solar Lords Closing School works with official, state-supported clean

energy programs that lower emissions and offer guaranteed savings.

Promote clean energy in your community and earn with us!

Level-Up Your Life In Just 2 Minutes A Day!

Each Morning You'll Receive And Email Showing You "How To Turn A SOLAR Side Hustle Into Your Only Hustle, Monetize Your Networks and..."

EXPERIENCE A 10X GROWTH IN FREEDOM

"I love This Newsletter! It provides simply, easy to use golden nuggets to help me break out of the rat race of 9-5!"

STEP #1:

Watch Bibliomania

"Can One Book Really Be Worth $1.5 Million Dollars?"

STEP #2:

Join The Community

And We'll Ship You Unpublished Napoleon Hill Books... For FREE!

Hey, Mike Morris Here...

If you’re on this page, then it means you’ve been invited to

participate in our upcoming “Secrets Of Success” launch.

NOTE: THIS IS NOT A NORMAL PRODUCT LAUNCH…

This is launching a new movement, that will pay you long term,

residual commissions over time. My last startup we launched

(you’ve probably heard of it… ha ha - Solar Lords Closing School,

paid out over $100 MILLION in commissions it’s first 10 years).

This should do similar, and I want YOU to get your part of the

$100 million…

And you are here at the beginning… before anyone else even

knows about it. Here is a video to explain to you the full visio

n of where “Secrets Of Success” is going:

The FULL Vision

Of 'Solar Lords Closing School'

Told you this was different then anything else online right

now... :)

As you can see, that is where ‘Secrets Of Success’ is going… but today we launch the

movement with our first offer, the Secrets Of Success membership site!

How Is This Different... For YOU!?!

We are not looking for you to do a quick promotion, and it be over. We're looking to

become partners with you as we launch and grow this amazing community of "Round

Pegs in Square Holes..." (This will make more sense when you watch the launch

campaigns... ha ha)

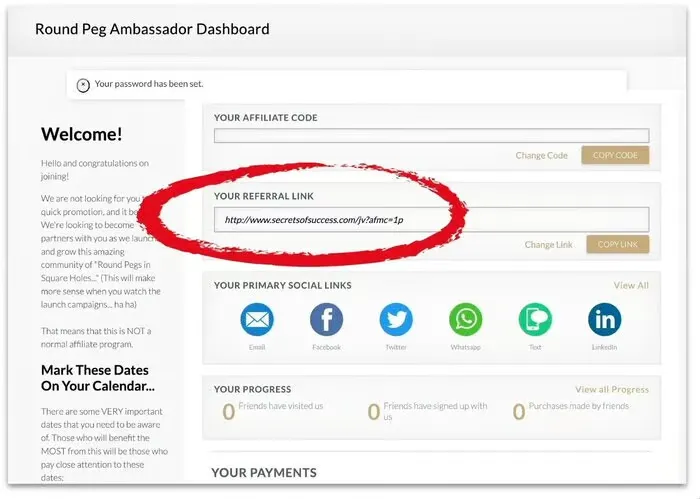

That means that this is NOT a normal affiliate program.

First - we are paying YOU 40% LIFETIME residual commissions!

Second - we are paying out TWO-TIER, so when your members refer others, you’ll get paid 10% LIFETIME residual commissions on all of those sales!!!

Important Next Steps For You To Crush It...

There are some VERY important steps to make sure you make the most of this opportunity. Those who will benefit the MOST from this will be those who pay close attention to these steps:

Phase #1 :

Recruit Your 2nd Tier Partners... (Live Now)

To maximize your opportunity you can invite your affiliates to this exact same page, and when they promote, you will get paid 10% lifetime commission on all of their sales!

Phase #2 : The M.I.F.G.E. Launch... (Live Now)

Our first launch is for the "Secrets Of Success," M.I.F.G.E. (Most Incredible Free Gift Ever)! You will be able to send all of your subscribers this box for FREE (They just cover the of shipping) and they will also get a 30 day FREE trial to the "Secrets Of Success" membership site! After 30 days, they'll be billed $97 a month for as long as they want to stay a member, and you'll make almost $40 PER MONTH PER MEMBER!!!

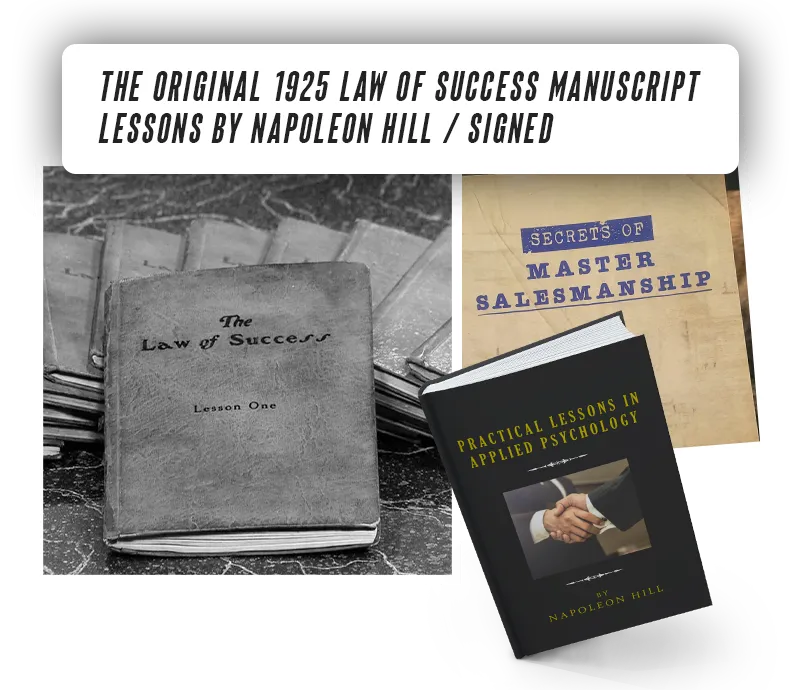

In the M.I.F.G.E. they will be getting a free copy of Think and Grow Rich AND two UNPUBLISHED books from Napoleon Hill!!!

** We have some really fun, unique things we'll be doing in the funnel as well, that should increase your cart value high enough that you should be able to profitably buy ads to promote the free trial and still be profitable on DAY 1!!!

Phase #3: The "Think And Grow Rich" Challenge... (T.B.A.)

Shortly after the M.I.F.G.E. launch is done, we will be launching the first ever, Think And Grow Rich challenge! Promoting this challenge will continue to build your recurring commissions! Each month we'll be rolling out new challenges to help get your existing members to stick, and give new members a fun, cool way to join each month!

What To Do Next...?

Step #1

After you signup, you can use this link to send people to this SAME page, and start building up your 2nd tier commissions!

Remember, you earn 10% LIFETIME RECURRING commissions from the members that your referrals refer!

Small Call to Action Headline

Step #2

If you have questions, or need anything related to the launch, connect with Justin Benton to answer any questions AND to make sure you have everything you need to build up this new residual income stream in your business!!!

Mike Contact Info:

(855) 463 0560

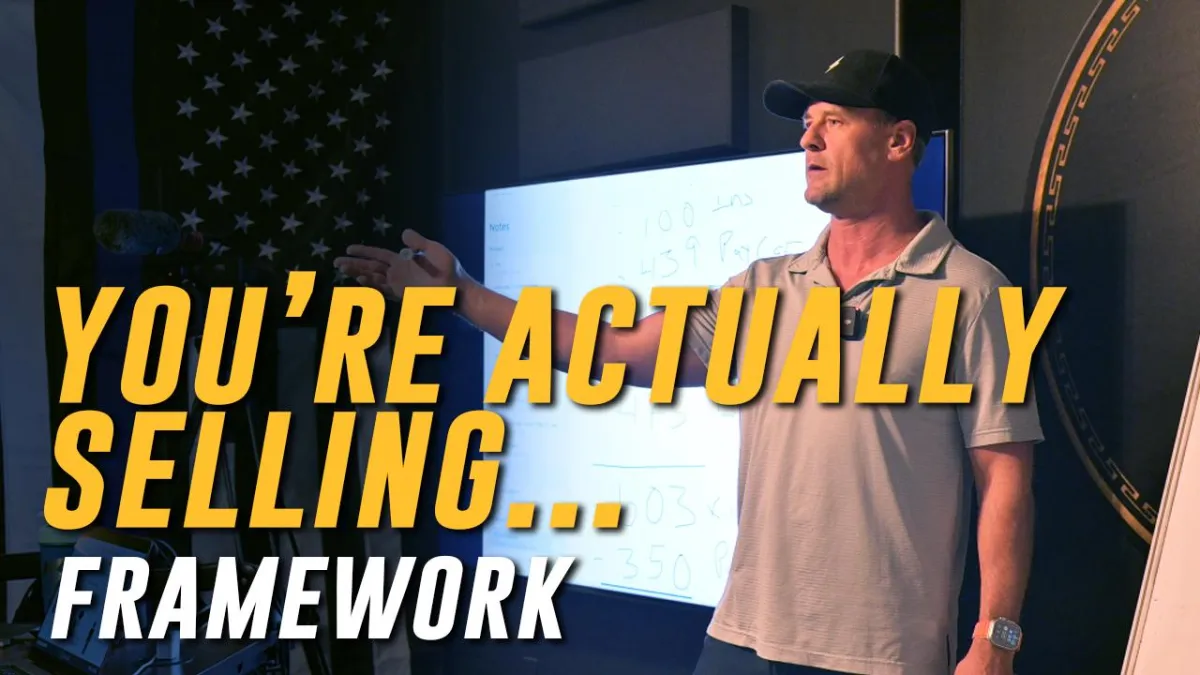

You're Actually Selling... Framework

“I found that selling what they actually want to buy is easier than trying to sell them what I've got.” - Mike Morris

So I made this thing up, you're actually buying, like when I go sell solar frequently I'm not even selling solar. Like I'm selling it but I'm not selling it, right? And so I mapped out a framework on what I do all the time and this is really what happens. And I didn't know what to call it so I called it You're Actually Selling… and then I said how to sell what the customer actually wants to buy.

My Product

Now, I found that selling what they actually want to buy is easier than trying to sell them what I've got. And so, I kind of mapped it out. I'm actually going to take you through an actual example that I'm working on with one of your clients right now. So, here's my product. This is what I got. But then during this course, there's a discovery that takes place during this conversation. And this is what I discovered. This is what the customer actually wants.

Customer Wants

And then I said, "Okay, here's the utopia." So then in the end, I paint the picture. This is how you get what you want. And for fun, I said the magic formula is Solar + Customer desires = utopia. So let me show you how I took that right there and how I'm working on that with your customer. It'll be helpful, you can see this.

So your customer, for example, has a couple of major problems. Major problem number one, insurance. Their insurance provider is saying you live up here in Elkridge, we're kicking you off the insurance because we don't want the exposure to it. And so she's got this fear in her eyes and she was quoted $3 ,600 for her insurance, okay? Just her homeowner's insurance. Then at the same time she's got this other problem which is the roof. Her roof, like the insurance companies, are coming out and they're saying, “Well, we're gonna exclude your roof because your roof's garbage and we're not gonna sign up for that liability because you're gonna come and say ‘Hey I need a new roof because [this] happened.’ Your roof was a piece of junk to start with.” The insurance company has a big issue with the roof so she's got a roof problem.

The third one is they took out a 100k HELOC. Does anybody know what HELOC stands for? Home Equity Line Of Credit. HELOC. Second mortgage on the house. She took out HELOC because what she really wants is a fence. She wants a kitchen, a hot tub. I remember that. So she wants all this stuff. And so she's trying to figure this all out. And when I sat down with her, I was like, "Okay, let's figure out exactly where you're at right now. You're paying $475 dollars for your electricity. If you were to go out and get a roof…” If she was to go out and get a loan on a roof, I think the payment on the roof was like $212 just to go get the roof.

And so what she really is going to kind of run into, she's got a cash flow problem. Because on this HELOC, if she does all this stuff, we figured it out to be $993 per month, is what her real problem is. So she spends $100 grand, they charge her $993 a month on that $100 grand, and that's how it played out. She needs a roof, so that's $212, and so she's got that problem. So if she takes this plus this, it's a big, you know…it's a pile of money that she's got to suck up out of it.

Customer Gets

And I'm like, “You know what?” So, when I'm sitting there and it comes back to this graph right here, this is what I got. But then I discovered during the process that this is what she wants. I'm like, “You know what? Let's do this.” And so then it comes over here and I said, “Okay, check this out. Let's see what this does. So, you've got for the roof and the solar, your payment comes out to $521 but you got to keep in mind you got a new roof and solar all in it.” So we did the math. I said, “So if you take $521 minus $475 that was like almost 50 bucks. I mean for 50 bucks you'd get a brand new roof. Like, that's got to be better than paying $212. I'm like, “Okay, so this right here solves the problem.” Then I said, “Okay, come over here and switch your insurance.” So I gave her my insurance and it came in at $1 ,700. I'm like, “Okay, cool, check this out.” She really has a cash flow problem. That's really the problem I would suggest trying to solve.

“Okay, since we made this shift, you just saved $100 a month on your insurance.” And she's like, “Oh my, was that true?” She has. "Yeah, it's true. It's totally true." I'm like, "Okay, cool. So you just saved $100 bucks.” And then I said, "What I'll do is…” because her husband's kind of on the fence. Actually, I think that he had an injury in the military that makes him think a little slower. I think he's having a hard time thinking through it. Well, what I discovered in the conversation is that she's got a car payment of $430 a month and she owes basically $3 ,000 on it. I'm like, "$3 ,000? So what if I give you $2,600 back in cash? That means that the car would be paid off by four months, three months, we would have the car paid off.” And she's like, "Yeah." And I said, "Well, that would help, wouldn't it?" She goes, "Yeah." I'm like, "So that would free up $439 because it got the car paid off." And she's like, "Yeah, that would be awesome." I'm like, "Okay, cool." Then the insurance company said that if she puts a new roof on it, they'll give her another $110 off on the insurance. I'm like, "Okay, cool, check this out. So between paying off your car this and this and this, your monthly cash flow going out, actually came out to negative 128 bucks. I'm like, "Is that true?" She's like, "Yeah." Because I'm like, "So you don't have to pay your electricity anymore because we got enough negatives on here to get rid of that.”

So I mean probably she's still got to make this payment. Well actually her electricity is still there but her roof. But she still came out with a negative $120 cash flow. Oh, then we pulled out her electricity, minus 475 and that gave us some number, because she's making that payment but she doesn't have to make her electric bill payment now. I said, "So that freed up 475 bucks. That gives you a negative $603 per month cash flow. Does that make sense?" She's like, "Yeah, I'm okay."

“My dude, how much is your truck? How much do you owe on it?” He goes, "I owe seven grand." I'm like, "You owe seven grand? Oh, check this out. If we take and save this money times 12 months, in 12 months you'd have 7 ,236 bucks. So in 12 months we can pay off your truck. Is that true?” They're like, “Yeah, that's totally true.” I'm like, “Cool. So now we have a negative 603, plus you just paid off your truck right here at 350 bucks. So minus 350. Now you have $953 leftover that you didn't have to pay.”

And this right here is actually wrong because it was two dollars away. So this was 955 bucks. That's what it came out to. Alright, 953 dollars is what we save. Like 955 bucks, that's what your kitchen and your fence is. I might check that out. This right here completely offsets this right here. I'm like, “So you can have your roof, you can have your fence, you can have your kitchen, you can have it all.” She's like, “I'm ready to sign. Yeah I'm ready to sign.” But he's like, “I want to make a smart decision.” I'm like, “Okay let's walk through it.” We walked through all this stuff running the math, equations, math, math, equations, running it, running it, running it, running it.

We kept doing this and playing around and, anyway, it was kind of a trip how we got them doing it. In the end the wife was like, “This right here would offset that so you can have it all. I’m ready to sign” She looked at her husband and said, “I want to do it.” He said, “I really want to make a smart choice.” I'm like, “Hey, honey, how do we get him to buy? You know him well enough. What is it that it takes for him to buy?” And she's looking at him and she's talking to him and she's trying to massage him and doing this, and working him left, working him right, and up and down, then sideways and just tapping him on the head.

So, he wants to think about it. I think what he was really saying is “Thank you for making this so that I can pretty much understand it, but I really need my wife to sit down and explain it better.” And so I rescheduled to come back. But she was like, “I'm ready, I'm doing it, let's do it. Come on, let's do it.” She's just being a good wife, and being patient with her man. But she's all in.

That's what I mean when I describe this stuff to you, that frequently I'm not selling solar. I'm selling her a roof. I'm selling her a way to get a kitchen and hot tubs and all this.

Learn more about getting the Solar Lords Closing School news letter. In this news letter I share the frameworks that I have discovered over the last 8 years.

If you think about it, one simple framework would save you hundreds of hours and make you several thousands to hundreds of thousands by simple using tested tools.

Learn More > Solar Lords Closing School

Case Studies

Isaac Reid

"I went from selling pest control out of state making $5K/mo to staying home and making $23K a month. It's crazy I left my state when all I needed was a new opportunity."

These results are not typical

Isaac Case Study >

3 Solar Closing Secrets

How To Double Your Conversions

Ever considered there could be 3 easy Secrets that if you implemented, it could double or triple your sales?

When I was a Newbie trying to figure out how to get just 1 person to buy solar from me, I came across 3 Secrets that once I implemented, it changed everything for me.

What's crazy is, even though I have worked with other productive sales reps, I thought what I knew was universal and they were all using it...boy was I wrong.

Here are the 3 secrets and why they work...

Featured Posts:

Think and Grow Rich

The Law of Success

Outwitting the Devil

Napoleon Hill

Author, Salesman, Journalist.

Napoleon Hill (October 26, 1883 – November 8, 1970) was an American self-help author and pioneer in personal development and success philosophy. He is best known for his book "Think and Grow Rich” (1937), which is among the best-selling self-help books of all time. Hill's teachings continue to guide people toward unlocking their potential, overcoming challenges, and attaining financial and personal success. With a legacy spanning decades, Napoleon Hill's profound wisdom inspires many to harness the forces of the mind and create lives of abundance and achievement.